After two weeks yelling at Siri to “make me some cash”, I gather it’s not going to happen. Apple really shouldn’t release these features before they’re ready. And the finance apps aren’t any better; I’ve downloaded like 500 of them, but the only difference is my bank account shrunk by $495. Still, there are solid apps that stand out from all the rubbish in the store; and I have five of them listed here:

In our next upgrade, Siri swears at you on full volume when you swipe your credit card.

1. Lemon.com Wallet

Lemon, yeah, that describes the condition of most Singaporeans’ savings. Going sour. Anyway, the lemon app creates a digital backup of your wallet.

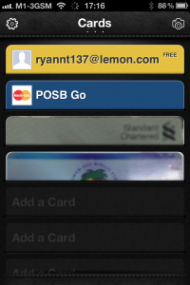

Lemon lets you scan and categorize your credit and debit cards. There’s a PIN to view the card details, which stops this app from taking first place in Identity Thieves Quarterly. The upside to this is that you don’t need to dig out your cards all the time: If you’re at the AXS machine, for example, you can check your phone and enter details instead of using the card.

It also works for things like ICs. Sort of. The images can be fuzzy, and for some reason the App’s default label for my IC was “Batman”. Huh.

Squint harder. Feel free to invade my privacy and all.

Lemon also lets you scan receipts, and tallies them for you. You can opt to see the accumulated receipts over the last 7 days, 30 days, or on a specific month and year. For convenience, divide them into your own expenditures and your family’s expenditures.

Apart from some teething problems (it can take annoyingly long to scan some receipts), this is a solid money management app. Oh, and it’s free.

2. Piggie

As in Piggy Bank. This is a budget management app; what makes it stand out is simplicity.

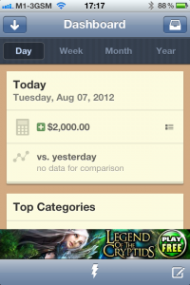

Open Piggie and you’ll see many lists of expenditures. You can check the history of your expenses by day, week, month, or year. Piggie also draws up a Today vs. Yesterday comparison, so you can see if that new credit card is throttling your common sense.

Below the list are two buttons: One to input new income or memos, and another to key in expenses. Try to input an expense, and the app will ask you for a category: Dining out, groceries, petrol, etc. It’s quick and painless to input expenses, which is what makes Piggie shine: Just tap the category and you’re done.

Piggie needs an accumulation of data to get going. But it’s easy to read.

My only gripe with this app are the instructions. Mainly, they don’t frigging exist. After the download, you’re left to figure everything out on your own. I wouldn’t have spotted the wireless Dropbox sync without 20 minutes of aimless twiddling.

Piggie is very basic; but unless your personal finance involves stock movements or something, it’s decent. It’s temporarily free in the App store, so get it now.

3. Toshl

The main point of Toshl is seeing where your money’s going. I already know the answer to that (out of my wallet is where) but Toshl makes it specific.

After Toshl gathers sufficient data (use it for a month or so), it draws up some spending graphs. Toshl tracks what categories you’re spending money in, how you spent most of it, and when you spent it. This is displayed in a bar graph.

I also like that Toshl uses a time graph:

Input is pretty straightforward; when you buy something, just enter the price and tap the appropriate tag. On that note: I do wish there were some pre-loaded tags; it’s annoying have to create them all from scratch. But once you have a range of tags it’s easy to just select from them.

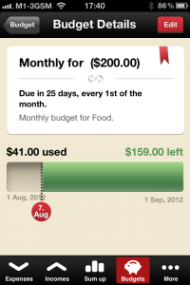

You can also pre-set a budget. For example, you could key in “Budget for food: $200″. Then every time you buy something and hit the “food” tag, it automatically subtracts from the food budget. The remaining amount in any budget is displayed like a life bar in a video game; quick and easy to check.

You can also select multiple tags for one purchase, in case you have multiple budgets going. So say I have a budget for “comics” and “novels”. If I input “books” as an expense, it could be set to deduct from both budgets.

Toshl is free; if something’s burning a hole in your pocket, use this to find the culprit.

4. Spendings

This is the most streamlined, no-frills personal finance app. Even Piggie looks more decorated than this.

Download Spendings and you get a tri-colour (black, white, and blue) list. It tracks your budget. If you want multiple budgets, you’ll need to buy the $0.99 upgrade; a bit off-putting, when apps like Toshl give you such features for free.

About as exciting as a pocket calculator I’m afraid…

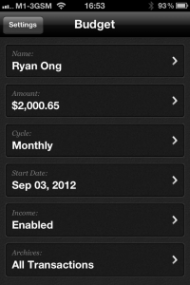

As with Piggie, there are no instructions. But no complaints there, because a chimpanzee could figure out how to work this. When you first open it, the app asks you a bunch of questions: Your name, how much you make, your payment cycles…just like talking to a gold digger at a speed dating event.

Once it’s all recorded, you just input expenses as they come; the app automatically subtracts from your budget. That’s it. The basic version of Spendings is free in the app store.

5. Oranges 2 Apples

Oranges 2 Apples is from Dan Ariely, who wrote

Predictably Irrational. The app counters the inherent lack of logic in our buying behaviour.

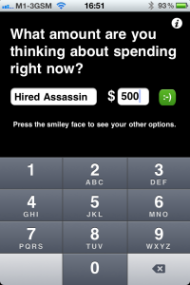

When you open the app, you’re asked to list your favourite things at different price ranges. The next time you want to buy something expensive, just input the amount. The app gives you a range of lower priced alternatives. For example:

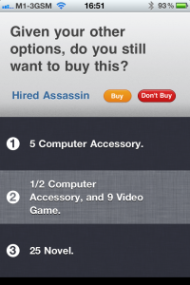

Based on my earlier entries, these are the alternatives the app gives me:

Who the hell buys half a computer accessory?

Keep insisting on buying, and the app will keep throwing alternatives in your face. So you’ll eventually be cured of the desire to overspend.

This app is free; so if you’re an impulsive shopper, download it.

Source: Yahoo Fiance

.jpg?m=1296472719)