Taking stock of moves to tackle financial challenges

AS the new year takes shape, a number of hazards are expected to challenge the state of our personal finances. An early warning arrived when the sugar subsidy was cut in Budget 2014, a bitter indication that food prices would soon be rising.

Soon afterwards, consumers got a second wake-up call when news broke that the electricity tariff would be raised by 15% from this month, which would inevitably have an economic ripple effect. Yet, the bombshell of the year may be the stunning increase in assessment rates of up to 300% by the Kuala Lumpur City Hall. Understandably, property owners have not taken the rate hike lying down.

External factors may also impact us, as the economic recovery in the United States has not been as robust as expected. There are clearly many threats beyond our control.

All these changes indicate that we are going to face more financial challenges this year. There is no better time than the present to take stock of our strategies to tackle these adverse developments.

However, one thing is in our hands and can make all the difference – at work or at home with regard to personal matters or our financial health – a positive, “can-do” attitude.

Eight Musts

Here are eight MUSTS that can open the door to financial success and a rewarding life this new year:

1. Determine the optimal return on investment (ROI) you need to achieve to enjoy financial freedom.

Everyone has a magic number by which they need their wealth to grow, say, 10% or 6%, that will take them to their financial goals. Simple as it sounds, there are real dangers for us if we are off the mark.

For example, without a target, we may be attracted to investments that promise unrealistic returns. Schemes like the under-probe Genneva Malaysia gold trading business or high-risk overseas investment plans are two perfect examples. So, be guided by sound parameters when making investment decisions.

Equally, if we set our ROI target too low, then we could become complacent about our financial plans, and run the risk of seeing inflation erode our asset value. As a result, the quality of life that we expect to enjoy may slip out of reach.

2. Set an optimal savings target, taking note that rising expenses will take a bigger bite out of our disposable income.

For example, the goods and services tax, when implemented in April 2015, and the continued cutting of subsidies will put upward pressure on the cost of living. On the other hand, the expected reduction in the income tax rate will put more money into our pockets. These two extra factors alone are enough to throw our current budgets off balance. Therefore, it is wise to review our current expenditure and adjust our lifestyle costs and savings targets accordingly.

As a rule of thumb, we should save at least 35% of our income, including our savings in the Employees Provident Fund, in order to meet our financial goals.

Just as crucially, we have to save and invest at the same time, as we need to grow our money faster than the rate of inflation to reach our financial targets.

3. Plan and provide for your cash flow needs before investing. This is absolutely crucial because without holding power, we are sure to lose money, no matter how good our choice of investment.

Guideline

As a guideline, we should set money aside for the following:

> Lifestyle funding. Working persons should maintain a six-month reserve, and the retired should have three years’ reserve on stand-by to finance living expenses, vacations, insurance premiums and housing loan repayments.

> Children’s university education funding. Keep the money ready three years ahead.

> Home purchase funding. Plan for financing three years ahead.

> Medical expenses funding.

4. Diversify and allocate your money.

A good rule of thumb is to allocate not more than 30% of our investable assets in a single asset class, such as property, cash, equities, bonds or commodities.

Taking a cue from Budget 2014, measures like the increase in the real property gains tax and the banning of the developer’s interest-bearing scheme to prevent the property market from overheating mean that the real estate sector could soften.

So, taking profit from the property asset class and divesting is a smart strategy. For example, if you have 80% of your investments in property, then you could cut it down to 40%, shifting to cash and equities instead.

5. Cut under-performers

Normally, when investing, we are very positive. For example, we may believe that our investments in unit trusts are going to perform well. In reality, however, we need to regularly monitor these investments. Say the fund promises to deliver a 10% return but is actually giving 3%, while peer funds are giving 11% or 12%. If this is the case, then it’s time to take immediate action. Many avoid taking that step because it is emotionally difficult to cut our losses. It is like jumping from a sinking ship. We must let go of our fear to make a new start.

6. Get a second opinion on any potential investment decision.

There are many innovative schemes being offered that attract retail investors, including oil palm growing schemes, offshore investment funds, gold coin trading, crude oil investment schemes and overseas property development schemes.

The best person to provide advice is usually an independent financial adviser licensed by the regulators. They are acutely aware of these schemes and know the inherent risks and benefits. Many of these schemes are clever at selling the apparent growth potential of the products, but are coy about their downside risks.

Questions to ask before signing up for these investments include:

> Is there a better option for the same type of investment? For example, instead of an oil palm grower’s scheme, it may be better to buy an oil palm company’s stock.

> If the promised return is 15% or 20%, is it deliverable?

> What is the potential for capital loss?

> Will my capital be safe?

Preferably, we should ask someone else these questions, and never ourselves, because when we are investing, we tend to be over-excited about the prospects of making money and often fail to answer these questions objectively.

7. Review your insurance coverage and the premium you are paying.

It is costly to have too high an insurance coverage if you already have enough insurance and assets to take care of your family. On the other hand, if your insurance coverage is too low, then your dependents are at risk of suffering a severe setback in case of any eventuality. Your insurance coverage is optimal if the total annual insurance premium you pay is less than 15% of your annual gross income:

Insurance premium ratio = total annual insurance premium/annual gross income (<15 p="">

Insurance for protection

If the ratio is more than 15%, then the chances are that you are paying too much for insurance. Rightfully, insurance is only for protection because insurance companies are not primarily dealing in the investment fund business, so, your money may grow slower than expected, and you may not have enough money for other purposes.

Note that while the above pointers are a rule of thumb, they may not apply to all age groups. As each individual will have different goals, it is best to tailor-make a financial plan that meets our specific needs.

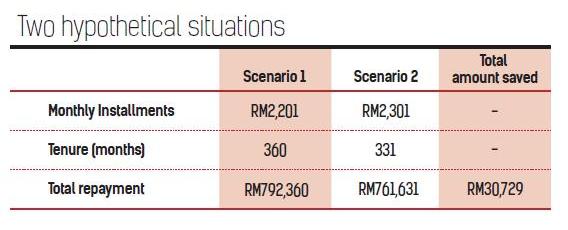

8. Develop a tailor-made holistic financial plan to identify the OPTIMAL level of financing for your needs.

An individual’s financial needs will vary depending on a number of factors. These include retirement living expenses, children’s tertiary education funding, medical expenses, loan exposure and insurance. It also depends on the age at which we wish to retire, our savings target and the expected ROI.

In conclusion, if we use these checkpoints purposefully, we will be well-positioned to make the right decisions about our personal finances and can manage challenging financial circumstances with confidence. In this way, we can make good progress towards achieving financial freedom at an optimal pace.

Here’s to a fruitful year optimising our money!

Yap Ming Hui (yap@yapminghui.com) is a best-selling author, TV personality, columnist and coach on money optimisation. He heads Whitman Independent Advisors, a licensed independent financial advisory firm which has helped people optimise their wealth and achieve financial freedom since 2000.