RM5 for a bowl of curry noodles? In my day, it was 50 sen!” Sounds familiar? No doubt you hear your parents and grandparents griping about today’s prices more often than not.

The reason for these price differences is simple and straightforward: inflation. We won’t go into the mechanics of inflation and its causes here; all we need to know in this context is that it devalues a currency over time by increasing the prices of goods and services.

Now, you might be wondering about the significance of inflation when it comes to mortgage loan repayments, and how you can utilize this knowledge. Let’s start from the beginning.

A misled mindset?

There’s a piece of conventional wisdom when it comes to property loans – pay them off whenever you have spare cash, and the more the better because you’ll be done with them earlier.

However, the opposite could ring true if you take into account the inflation factor. Simply put, RM1 – 30 years ago has a higher value than RM1 today due to inflation. Going by the same logic, RM1 now would obviously be of a higher value than RM1, 30 years down the line.

Imagine that a simple roadside meal will cost 10 times more, 30 years later. So, logically, paying ahead on your property loan instalments, you’d be using ringgit that would worth more compared to years down the line. Thus, wouldn’t you be losing out by paying more than you have to, despite shortening your loan tenure?

Inflation versus interest

Of course, the one major argument against this logic is that while you might save some money by outsmarting inflation, you would end up paying more anyway due to the huge amounts of interest over the years.

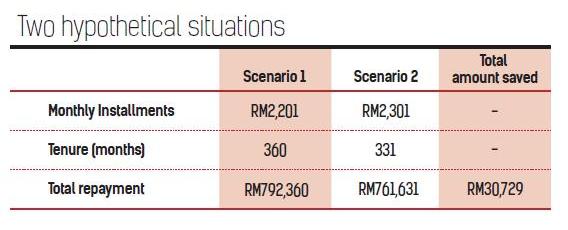

To gain a clearer understanding of the impact of inflation here, we have to get a little technical. Let’s take a home loan of RM450,000 paid over 30 years at a steady Base Lending Rate (BLR) of 4.2%. Your monthly repayment would work out to RM2,201.

For argument’s sake, let’s compare two hypothetical scenarios.

Scenario 1 – Standard repayments made to bank throughout tenure length

Scenario 2 – An overpayment of RM100 is added on each month throughout the tenure length

From the table above, it can be noted that overpaying your monthly

instalments consistently throughout tenure will save you RM30,729 in

total. But, does that value reflect the actual value saved when taking

inflation into account?

From the table above, it can be noted that overpaying your monthly

instalments consistently throughout tenure will save you RM30,729 in

total. But, does that value reflect the actual value saved when taking

inflation into account?Let’s now look at the two different inflationary scenarios to get a picture of how much value you actually stand to save from repaying earlier. All calculations are based on the discounted cash flow of the mortgage amortisation.

* Discounted cash flow payment = Payment/ (1+ (inflation rate)) number of months

If average inflation rate in Malaysia is at 4% throughout tenure: The amount saved after takinginflation into account = Only RM157in today’s ringgit. This is the value of the amountsaved based on present day value.

If average inflation rate in Malaysia is at 5% throughout tenure: You actually don’t save anymoney but end up “losing” moneyin a sense.The total amount lost after taking inflation into account = RM 2,786 in today’s ringgit.

From here, it becomes clear that by overpaying and saving that additional RM30,729 in the future, translated into today’s equivalent, the amount might be much less than you think simply because of the effect of inflation.

Summary

The mentioned scenarios were based on certain assumptions. What is more likely to happen is a random fluctuation in BLR and inflation rates over time. Still, the principles shown hold true.

What we want to highlight is how you can extract maximum value from your money by just following Loanstreet’s three simple rules for stretching the value of every ringgit.

In a nutshell:

1. If loan interest rates are higher than inflation:-

a. Pay off your Loan (This article disregards investment options)

2. If loan interest rates are lower than inflation = Use your money for either:

a. Investments or

b. Consumption items

3. In most situations, keep only a minimum amount of cash (in savings/ Fixed Deposits (FD), etc, as your money generally devalues over time (Though there are certain exceptions).

One final note, please remember not to discount the importance of saving. There are times when you just might need that extra cash, or must save up for a future use. Do, however, practice wisdom and save just enough for practical purposes.

This is our simple guide to stretching the value of every ringgit.

>> To find out more about the best home loan interest rates in the market, visit www.loanstreet.com.my

>> Loanstreet.com.my is a website that helps Malaysians compare and apply for loans online, free of charge.

No comments:

Post a Comment